Many consumers focus solely on the Annual Percentage Rate (APR) when evaluating credit cards, but this advertised interest rate alone only tells part of the story. A host of additional fees can quietly inflate your costs, turning what seemed like a good deal into an expensive burden.

In this in-depth article, we will explore the various hidden charges, provide real-world examples, and offer actionable strategies to keep your credit card expenses under control.

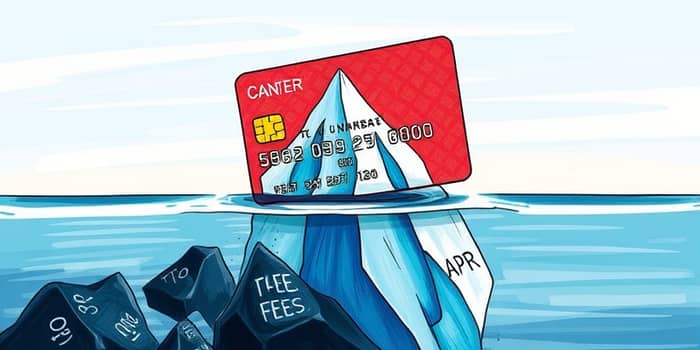

The APR reflects the cost of borrowing money in the form of interest, expressed as an annual rate. However, it does not account for a variety of other costs that can add up quickly. Relying on APR alone is like judging an iceberg by the tip you see above water—it ignores the vast, unseen portion beneath.

Credit card issuers are required by the Truth in Lending Act to disclose APR prominently, but detailed fee disclosures in fine print often go unnoticed until after you’ve signed up.

Beyond interest, many credit card products carry a range of additional charges that may apply depending on how you use the card. These fees can be one-time, recurring, or tied to specific transactions.

To put these costs into perspective, consider the table below summarizing common fee types and their typical ranges:

These charges can accumulate rapidly, especially when multiple fees apply to a single transaction—such as a foreign ATM withdrawal that triggers cash advance, ATM surcharge, and foreign transaction fees simultaneously.

Understanding hidden fees is easier when you see how they affect everyday spending. Consider these examples:

1. Online Shopping from Overseas: You purchase a $200 gadget from a foreign retailer. A 3% foreign transaction fee plus a 2% currency conversion markup adds $10, turning your expected $200 purchase into a $210 expense.

2. Hotel Booking Abroad with DCC: Opting into Dynamic Currency Conversion at checkout may feel convenient, but a 4% DCC fee plus your issuer’s 1% foreign fee can inflate a $500 hotel bill by $25, leaving you paying $525.

3. Cash Withdrawal on Vacation: Withdrawing $100 from an ATM may incur a $3 local ATM fee, a 3% cash advance fee ($3), and a 1.5% foreign transaction fee ($1.50), totaling $7.50 in fees in addition to higher interest rates charged from the transaction date.

By taking a few proactive steps, you can minimize or eliminate many of these covert charges:

Staying vigilant and informed can save you hundreds of dollars annually and protect your credit score from penalty APRs triggered by late or over-limit fees.

Federal laws like the Truth in Lending Act require clear disclosure of APR, but hidden beneath the surface are fees that only appear in lengthy terms or monthly statements. The CARD Act improved transparency by capping certain penalties and mandating clearer statements, but it did not eliminate every unexpected charge.

Issuers still rely on opaque pricing structures to recoup billions in additional revenue each year. In 2022, consumers paid over $105 billion in credit card interest alone, and additional fee revenues are estimated at tens of billions more.

When assessing a credit card, never stop at the stated APR. A card that seems cheap on the surface may harbor numerous fees that only become visible after a transaction or on your statement. By understanding the full cost structure, comparing cards holistically, and monitoring your account regularly, you can avoid unpleasant surprises and select a card that truly fits your spending habits and lifestyle.

Your financial well-being depends on being an informed consumer. Take the time to dig into fee disclosures, ask questions, and choose wisely. In the world of credit cards, knowledge isn't just power—it’s savings directly back in your pocket.

References